As the UK tightens the reins on its non-domicile taxation policies, casting a shadow of uncertainty over global investors and high-net-worth individuals, the spotlight turns to seek the advantage of Dubai. This dynamic city-state has emerged as a beacon of financial optimism, offering a compelling alternative with its advantageous tax system, strategic geographical position, and diversified economy. In this closer look, we explore why the advantage of Dubai is becoming increasingly appealing to those affected by the UK’s stringent tax landscape.

Why Dubai Offers a Brighter Future

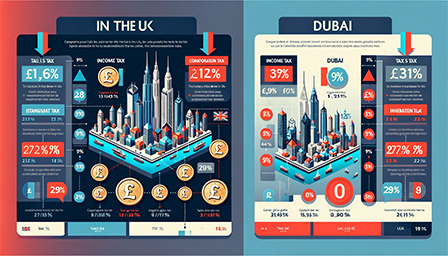

Dubai’s tax regime is a stark contrast to the UK’s. With zero income tax, no capital gains tax, and the absence of inheritance tax, Dubai offers a significantly more attractive proposition for tax optimisation. Beyond taxes, Dubai’s strategic location, advanced infrastructure, and commitment to innovation create an environment ripe for investment and business success.

The Advantage of Dubai: A Tax Haven in the Spotlight

Dubai’s tax regime stands in stark contrast to the UK’s recent policy shifts. With its promise of zero income tax, no capital gains tax, and absence of inheritance tax, Dubai presents a financially attractive proposition for individuals and corporations alike seeking to optimize their tax strategies amidst growing global fiscal pressures.

Strategic Location: Dubai’s Global Crossroads

Beyond its tax-friendly environment, Dubai’s strategic location as a gateway between the East and West offers unparalleled access to key global markets. This geographic advantage, combined with world-class logistics and infrastructure, cements Dubai’s status as a top-tier destination for international trade and investment.

Diversification and Innovation: The Economic Advantage of Dubai

Dubai’s economy is a testament to its resilience and forward-thinking approach. With a strong focus on sectors such as technology, finance, renewable energy, and healthcare, Dubai is not just diversifying its economic portfolio but also creating a fertile ground for innovation and sustainable growth.

The UK’s Tax Tightening: A Closer Look

The UK’s tax policy adjustments, particularly around non-dom status, have introduced a layer of complexity for those with international financial interests. These revisions aim to curb tax avoidance and ensure that those residing in the UK contribute their fair share. However, for many, this has translated into higher taxes, more reporting requirements, and an overall less hospitable environment for wealth generation and preservation.

Investing in Dubai: Opportunities Abound

The advantage of Dubai extends into its wealth of investment opportunities. From the bustling real estate market to cutting-edge fintech ventures and renewable energy initiatives, Dubai is ripe for investors looking to tap into emerging trends and industries.

The Advantage of Dubai: A Deeper Dive

Dubai is not just about tax benefits; it’s about the holistic support it offers to businesses and investors. From its world-class infrastructure and strategic geographic position to a diversified economy that spans technology, finance, renewable energy, and healthcare, Dubai is designed for growth. Through OffshoreBorders.com, explore how you can leverage Dubai’s dynamic ecosystem for your investment and business needs.

A Welcoming Business Environment

Dubai’s pro-business stance is evident through its supportive policies, including long-term visas for investors and a robust legal framework. This environment not only attracts global business but also fosters a competitive and secure marketplace.

OffshoreBorders.com: Navigating You Through Complexity

At OffshoreBorders.com, we understand the challenges that come with navigating the intricate web of global tax regulations. Our platform offers comprehensive guidance and solutions for individuals and businesses looking to optimise their tax strategies in light of these changes. From setting up offshore accounts to finding the most advantageous jurisdictions for your investments, OffshoreBorders.com is your partner in securing fiscal efficiency and freedom.

Conclusion: Why Dubai Stands Out

In the face of the UK’s evolving tax regulations, the advantage of Dubai shines brighter than ever. Offering a harmonious blend of tax benefits, strategic location, and a dynamic economic environment, Dubai stands as a leading destination for those seeking stability, growth, and opportunity in an uncertain global financial landscape.

you can checkout what the uk government have to say on the matter here

Customer Reviews

Thanks for submitting your comment!