The Rise of Cryptocurrency Gateways: A Comprehensive Guide

As digital currencies continue to reshape global finance, cryptocurrency gateways have become essential for managing transactions. They act as a bridge between traditional fiat currency and the digital asset world. In this guide, we explore how cryptocurrency gateways work, their benefits, and why they are gaining traction in today’s digital economy.

What Are Cryptocurrency Gateways?

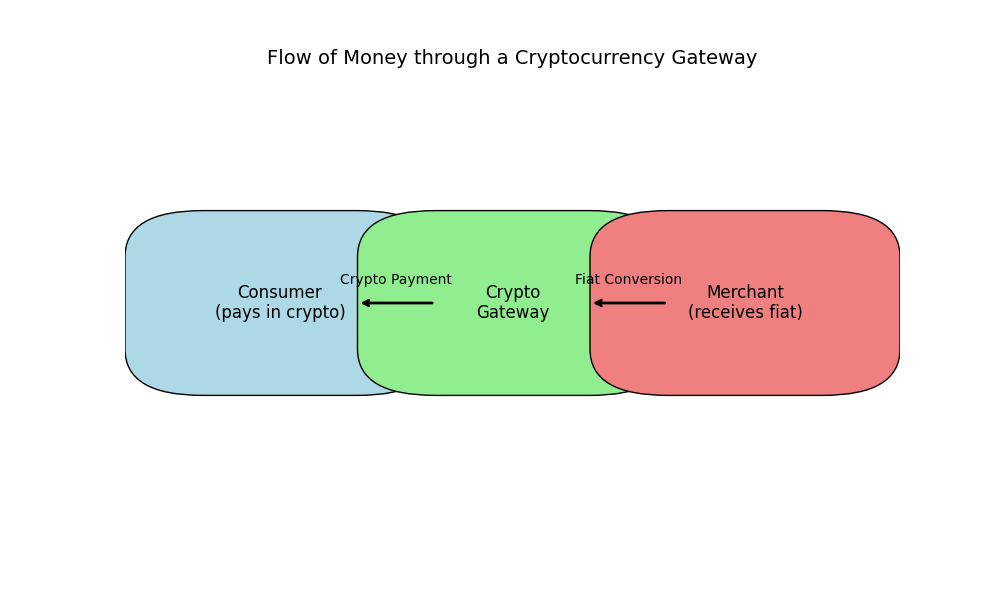

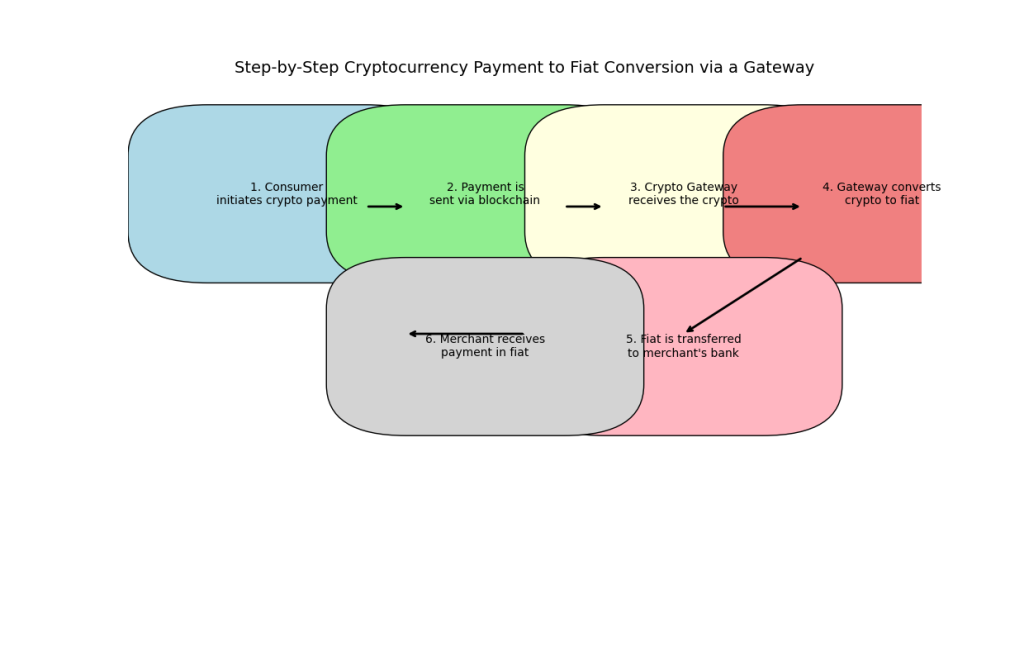

Cryptocurrency gateway are platforms that bridge the gap between the world of digital assets and traditional financial systems. Their primary function is to convert digital currencies, such as Bitcoin, Ethereum, or other cryptocurrencies, into traditional fiat money like USD, EUR, or GBP, and vice versa. These gateways are critical in facilitating secure, transparent, and efficient transactions, ensuring both individuals and businesses can interact seamlessly with the digital currency ecosystem without needing specialized knowledge.

For businesses, cryptocurrency gateways simplify the process of accepting digital payments. When a customer makes a purchase using cryptocurrency, the gateway handles the complex conversion, instantly exchanging the digital asset for fiat currency. This means businesses don’t need to worry about cryptocurrency volatility—they simply receive the equivalent value in their local currency, just like they would with any traditional payment method. Similarly, for individuals, cryptocurrency gateways offer an easy way to convert digital assets into spendable cash, which can be withdrawn or used for purchases via regular financial institutions.

How Cryptocurrency Gateways Work

Cryptocurrency gateway work much like traditional payment processors. When a customer makes a purchase using cryptocurrency, the gateway converts the crypto transaction services into fiat currency at current exchange rates. This means businesses don’t have to worry about the volatility of digital currencies, as they receive their payments in a stable form of currency, like dollars or euros.

For instance, if a business accepts Bitcoin via a gateway, that Bitcoin can be instantly converted into local fiat currency, and deposited into their bank account. This ensures seamless crypto-to-fiat conversions without risk.

How Cryptocurrency Gateways Work

Cryptocurrency gateway function similarly to payment processors, but with a focus on digital currencies. When a customer makes a payment using a cryptocurrency, the gateway converts the digital asset into fiat currency at current exchange rates, allowing the merchant to receive payment in a form they’re comfortable with.

For example, if a merchant accepts Bitcoin through a cryptocurrency gateway, the gateway instantly converts that Bitcoin into the local currency, depositing it into the merchant’s bank account. This eliminates the risk of volatility commonly associated with cryptocurrencies, providing stability and trust in transactions.

Benefits of Using Cryptocurrency Gateways

The advantages of using cryptocurrency gateway go beyond simple conversion. These services offer several benefits to both businesses and consumers:

1. Simplified Crypto-to-Fiat Conversion

Cryptocurrency gateway offer fast and straightforward conversions, eliminating the complexity of trading digital currencies on exchanges. This feature is especially valuable for businesses that want to accept cryptocurrency payments but prefer to receive fiat currency.

2. Enhanced Security

These platforms employ advanced security measures such as encryption and two-factor authentication (2FA) to protect users’ funds and information, making them a safer option for managing digital currency transactions.

3. Global Access

Cryptocurrency gateways enable businesses to expand their reach by accepting payments from international customers who use digital currencies. This can be particularly beneficial for e-commerce platforms looking to broaden their customer base.

4. Reduced Transaction Fees

Compared to traditional financial institutions, cryptocurrency gateways often charge lower transaction fees, making them a more cost-effective option for businesses processing a high volume of international payments.

Popular Cryptocurrency Gateways

Several companies have developed reliable and user-friendly cryptocurrency gateway. Some of the most popular options include:

Coinbase Commerce: A well-known platform that offers businesses an easy way to accept cryptocurrency payments while automatically converting them to fiat.

BitPay: One of the pioneers in cryptocurrency gateway, BitPay supports a variety of digital currencies and allows users to receive payments directly into their bank accounts.

CoinPayments: Known for supporting over 1,900 different cryptocurrencies, CoinPayments is ideal for businesses that want to accept a broad range of digital currencies.

Why Businesses Should Consider Cryptocurrency Integration

For companies looking to stay ahead of the curve, integrating cryptocurrency gateway is no longer optional—it’s essential. The growing number of consumers using digital currencies means businesses must be prepared to meet this demand. Cryptocurrency gateway provide a simple, secure, and efficient solution for companies interested in accepting digital payments while minimizing risks associated with market volatility.

In addition to attracting a broader customer base, businesses that adopt cryptocurrency gateways are seen as innovative and forward-thinking, which can enhance their reputation in competitive markets.

Challenges and Considerations

While cryptocurrency gateway offer many advantages, businesses and individuals should consider a few challenges:

Regulatory Uncertainty: Cryptocurrency regulations vary by country, and businesses need to ensure they comply with local laws.

Market Volatility: Although gateways offer instant conversion, users should still be aware of the potential impact of cryptocurrency price fluctuations.

Technical Integration: Setting up a cryptocurrency gateway may require some technical knowledge, although many platforms offer support and tutorials to ease the process.

Embracing the Future with Cryptocurrency Gateway

As the use of digital currencies grows, cryptocurrency gateways will become even more integral to global commerce. By offering seamless crypto-to-fiat conversions, enhanced security, and global reach, these gateways enable businesses and individuals to engage in the digital economy confidently. Whether you’re an e-commerce platform looking to expand globally or an individual exploring cryptocurrency, integrating a reliable cryptocurrency gateway could be the key to future-proofing your financial strategy.

Ready to explore the world of cryptocurrency gateway? Contact us today to learn more about how digital currency integration can benefit your business.